E-tds Return Preparation Software

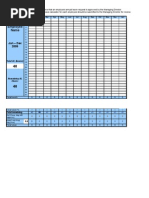

India's leading e-TDS Return Preparation and TDS e-filing Software on the cloud. ClearTDS TDS Filing Software Compared to NSDL RPU Utility.

:: EASITAX:: easitax:: File I.T. Return Online, e-return intermediary, Official Developer of Tax Information Kiosk in various Chief Commissioner Office, SAMPARK Return Preparation Software by Income Tax Department of India, Purchase Sampark CD, Tax Management Software, Tax Information Kiosk, Bulk Processing Software, Integrated Hitech Ltd, Chennai, easitax.com easitax e-TDS 11.0(for Quarterly)released. Price: Unlimited Version Rs 2000/- Order Now.

TDS or Tax Deducted at Source is an indirect system of deduction of tax by Indian authorities according to the Income Tax Act, 1961 at the point of generation of income tax. Multiplayer Crack For Splinter Cell Conviction. Tax is deducted by the payer and is remitted to the government by the payer, on behalf of the payee. TDS can be filed through Taxraahi TDS software. A TDS Return is a quarterly statement which can be submitted via utility or TaxRaahi TDS software. Submitting TDS Return is mandatory if you are a deductor. It has details of TDS deducted and deposited by you. Tax Deducted at source as the name suggests collection of tax at the origin of the Income i.e.

As and when income is earned. The income tax act requires that the person (deductor) who makes the payment to any other person (deductee) shall deduct at certain percentage tax while making the payment and remit the same into the account of central government on behalf of receiver of such payments.

Thus the recipient of income (deductee) receives the amount net of taxes. The recipient of income can claim credit of this TDS while filing his income tax return on the basis of FORM 26AS or TDS certificate. The TDS return is simply a statement giving quarterly summary of tax deducted along with PAN of payee (deductee), Payment details etc. Every deductor shall file a quarterly return for Tax Deducted at Source in form as prescribe prescribed on or before due date. You can file TDS return through TaxRaahi TDS software in just 5 simple steps: 1. Add Deductor: Add Deductor details such as TAN Number, Address etc. You can also import from excel sheet or conso file.

Add and Verify Challans: Enter challan details and verify challans from OLTAS directly with our TaxRaahi TDS software. Add Deductees/Employees: Add deductees along with their PAN and TDS Details. Match Challan with Deductees: Choose the challans for each deductee. If any challan amount is unused is can be carried forward to next quarter. Verify Return and Generate FVU for TDS Return Filing: Check for suggestive and validation errors.

Once all the validation errors are fixed you can generate FVU from our TDS software.